Supply chain disruption - nothing new

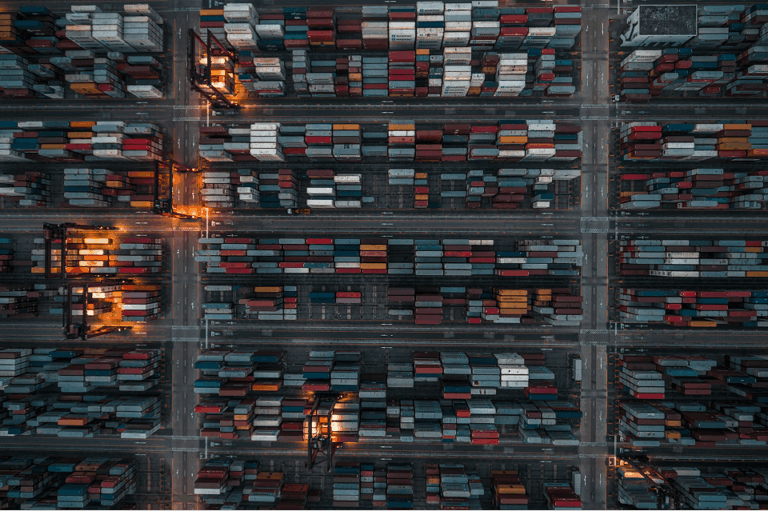

Supply chain disruptions hit the headlines during the COVID-19 pandemic when it became everyday news. Stories of port closures, truck driver shortages and factory closures were commonplace. However, disruption in supply chains is not a recent development. The 1600s was the dawn of global trade with the formation of international merchant trading companies like the Dutch East India Company (VOC), the English East India Company and others.

Cargoes of spices transiting from Asia to Europe were at the mercy of storms, disease, and piracy to name just a few of the hazards of that time. So precarious were supply chains in the 1600s that the VOC employed an army of 10,000 soldiers and owned 40 warships to protect and expand its operations. In 1603, the Portuguese merchant ship Santa Catarina was seized by the VOC. The ship was laden with a cargo so valuable that, upon sale, it increased the assets of the VOC by 50%. But think also of the disruption to supply into the Portuguese supply chain and the price increases for those precious spices.

During the 1990s and 2000s we established long, low-cost supply chains which remain the foundations of most manufacturing and retail business operations today. The global financial crisis of 2008 to 2010 slowed down the move East but it didn’t fundamentally alter our mainly lean global supply chains, served by production from China and other parts of Asia. We has become hooked on low cost and didn’t anticipate that the inherent inflexibility these long chains bring was operationally, financially, and environmentally unsustainable. But our supply chains have been blighted with political, economic, and environmental disruptions for decades, as illustrated in Figure 1 below. The graphic also shows major events since the late 1990s alongside global GDP and Oil price as an indicator of the impact on business and trade.

Today’s extended global supply chains are arguably more robust than those of the 1600s; shipping lines today do not employ tens of thousands of soldiers, but there remain hot spots of conflict that shipping fleets avoid or transit under the protection of international forces like the US and UK navies. But supply-chain disruption is not limited to the high seas. Economic conditions are driving demand volatility and placing some businesses under threat of bankruptcy; the conflict in Ukraine is disrupting supplies and driving up prices of commodities such as wheat and natural gas; and on the ground, labour unrest is manifesting in industrial action, closing factories and distribution operations, albeit temporarily.

A 2022 survey by McKinsey & Company found that supply-chain disruptions lasting one month or longer now occur every 3.7 years, on average. It also found that these disruptions cost the average organisation 45% of a year’s profits over a decade. A Gartner survey of Chief Supply Chain Officers in December 2021 found that 68% of supply-chain executives reported that they had been constantly responding to high-impact disruptions over the previous three years. Some 67% reported they had not had sufficient time to recover from a disruption before another high-impact event had disrupted their supply chains again.

It isn’t all doom and gloom, though. A recent report published by Resilinc stated that supply chain disruptions were on the decline in 2023, with a decrease of 5% year-on-year. In 2023, the top five disruptions were: factory fires, mergers & acquisitions, labour disruptions, business sales, and factory disruptions.

While the Resilinc survey suggests we endured fewer disruptions in 2023 than 2022, Figure 1 reminds supply-chain owners that we cannot rest on our laurels. Disruption is what supply-chain operators manage every day, with the typical mitigators being: safety stock, safety capacity, supply flexibility, and expedited transport. But since the global pandemic, building greater resilience into supply chains has become a facet of business strategy with many looking to balance investment in operational cost efficiency, service improvement, profitable growth and, at the same time, bolder strategies to reduce environmental impact and improve resilience to disruption.

Visibility and resilience - supply chain panacea

We do need to be preparing our businesses for the increasing occurrence of significant disruption. We need to be able to spot the disruption or risk of disruption early and establish how to respond quickly and – importantly – in a cost effective and environmentally sustainable way. Building a resilient supply chain is about laying down strategies for identifying, predicting, and responding to disruption, efficiently and with an acceptable impact on profit and planet.

With the complex, long supply chains we have developed, it is essential that we get early sight of disruptions, or possible disruptions. This gives us maximum time to respond. With global data networks gathering minute-by-minute data of where goods and transport are located on the globe, overlaid by the weather and event data that tools such as Resilinc capture, it is now possible for supply-chain managers to be alerted to disruptions within minutes of them occurring, regardless of where in the world they occur.

When the captain of the Ever Given parked his container ship across the Suez Canal in March 2021, blocking it for six days, this created chaos for traders using that route (one of the busiest in the world) to and from Europe/Asia.

Nobody could have predicted this event but supply-chain operators who had invested in global visibility solutions (from vendors such as Project 44 and Blue Yonder) were able to determine the impact to their supply within an hour of it happening. This allowed them to rapidly develop short term solutions to the disruption, thus minimising impact to their customers. Without this technology in place, it could have taken one to two days for shippers to find out there was a problem and then many subsequent days to establish the impact of the disruption.

Visibility of disruptions is not enough, though. Projecting the impact of the disruption is also key, followed by working through the scenarios of short, medium and long-term solutions to the disruption. Here it is essential that global visibility tools are integrated with supply–chain planning solutions that can look forward and evaluate the different options that exist to put in place a more robust solution that meets the business’s financial and environmental objectives. All too often these solutions are not integrated so there is a tendency to look at short, medium and long-term solutions in isolation, which can result in sub-optimal decisions.

Strategies for Resilience

The strategic options for building a more resilient supply chain revolve around a combination of 6 primary approaches, each with financial and environmental consequences, good and bad:

Manufacturing networks with alternative sources / make and buy options / near-shoring.

Good for service, good for environment but can increase cost to service

Distribution network with local warehousing and transport alternatives

Good for service, good for environment but can increase cost to service

Sourcing networks of alternative local and global suppliers

Often a cost impact but conversely a benefit to environmental measures and good for service levels

Product portfolio around rationalisation, mass configuration, postponement, and standard platforms

Good for cost, service and environmental measures

Inventory and capacity buffers and flexibility

Good for service and may be good for cost management but the environmental impact can be detrimental if it leads to obsolescence, can increase cost to service

Collaboration – giving better visibility of demand changes, supply reliability and any risks

Good for service, good for environment and can help keep costs in check

The solutions that are best for a business are very unique; there is no silver bullet, and each business must establish the level of likelihood of risks occurring, the impact of those risks were they to occur, and then determine the best all-round strategy for building resilience against the potential disruption.

Is digital transformation next?

Driving next-level performance today requires smarter supply chain technology to increase end-to-end visibility, predict and respond based on data-driven insights, and accelerate decision-making.

Digital transformation has become integral to modern supply chains. It’s not just about keeping up with technological trends; it’s about survival. The COVID-19 pandemic exposed vulnerabilities within supply chains, emphasizing the need for companies to adapt quickly to changing circumstances. With economic challenges persisting post-pandemic, supply chains must adjust to remain profitable.

The next level of performance in supply chains hinges on three key advancements: predictive capabilities through machine learning, visibility through access to detailed real-time data real in a digital twin of supply chains, and end-to-end optimisation ensuring seamless processes.

Real-time visibility remains indispensable as it underpins future complex, interwoven supply networks’ functionality.

Digital transformation isn’t merely advantageous—it’s essential for supply-chain operators aiming not only at current relevance but also future viability amidst evolving economic landscapes marked by uncertainty yet brimming with technological potentialities.

The road ahead

The future of supply chains is being reshaped by a shift towards localising critical components and embracing predictive and generative AI. As companies break through the experimental phase, AI and machine learning will become standard tools in the supply-chain arsenal – a far cry from the warships and armies of the 1600s.

Real-time visibility will be the backbone of tomorrow’s intricate supply networks, ensuring that companies can navigate the complexities of global trade with confidence. Integrating real-time visibility into the decision-making process, alongside collaboration tools to facilitate deeper connections across multi-tiered vendor systems, improves the likelihood of better outcomes.

Summing up

In essence, visibility and resilience strategies will guide supply-chain operators through the troubled waters:

The digital imperative

Digital transformation is no longer optional for the manufacturing and retail sectors — it’s a matter of survival. The pandemic has shown us the need for agility and adaptability.

Predictive power

Imagine predicting supply-chain disruptions before they strike. That’s the reality with advanced supply chain technology. Companies with visibility solutions navigated the Suez Canal crisis with ease while others faced extended periods of disruption and a void of information to keep customers informed.

Visibility is key

Achieving end-to-end visibility in supply chains is crucial. It’s about seeing the full picture and being prepared for any scenario. Take an integrated approach to visibility and short, medium and long-term decision-making through end-to-end supply-chain planning.

Resilience meets sustainability

In today’s economy, resilience and sustainability go hand in hand. Strategies like near-shoring and product platforming not only help the environment but also enhance market responsiveness. Long supply chains increase risks and make course correction harder and much longer to achieve. Short supply chains are naturally more aligned with financial and sustainability goals.

1 The data was collected by Resilinc’s EventWatch AI, a 24/7 risk-monitoring database.

2 Supply Chain Resilience is the ability of an organisation to avoid, absorb and recover from the business impact of major disruptions through a risk-balanced approach to product, supply chain strategy and network design. (Gartner, November 2021)

Alan Duncan

Alan Duncan has over 30 years’ experience in supply chain management in a variety of manufacturing industry sectors. With extensive experience from operational leadership roles, technology vendors and advisory consulting, Alan now works closely with leading manufacturers to ensure they maximise the value from their technology and supply chain investments.