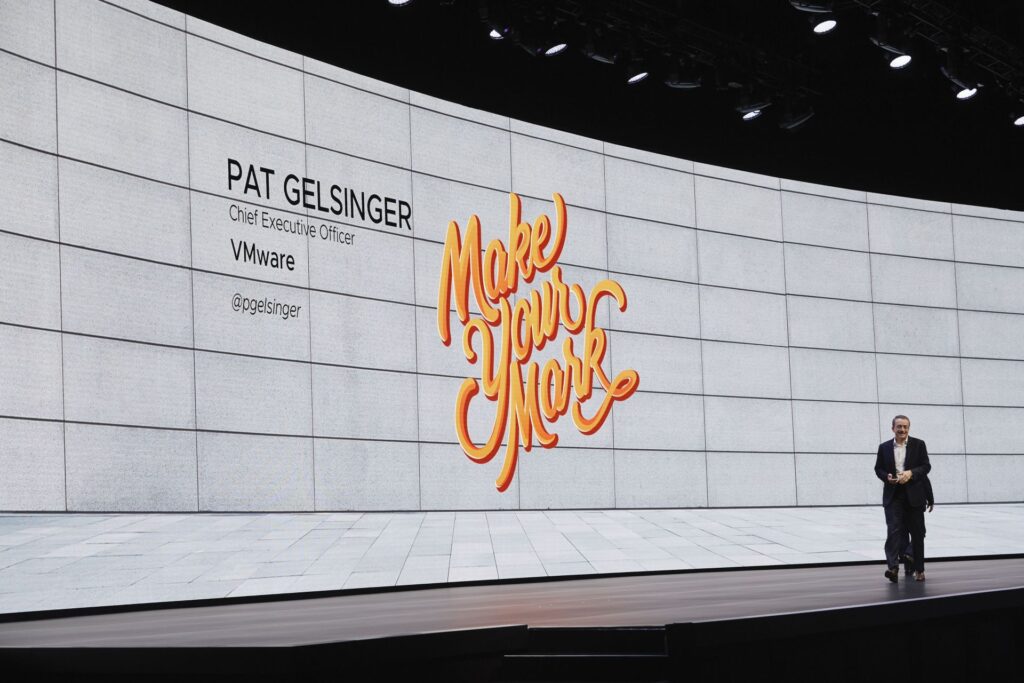

“A VMworld event is like a Rolling Stones concert, because we don’t do many of them,” smiles Sanjay Poonen, VMware’s COO of Customer Operations. “It’s a great chance to meet with our closest friends and partners.”

In which case, VMware has a pretty big group of friends: 14,000 attended the company’s European set piece event, VMworld Europe 19, held in Barcelona in November, which at various points felt part technology event, part exhibition and, in keeping with Poonen’s analogy, part rock gig – the three days are closed out with a set played by the Stereophonics at ‘VMfest’. Bear Grylls is also drafted in to give a keynote address, which he does to a captivated and capacity audience.

But the true stars over the show are VMware’s executive team, who are met with packed halls for their own keynotes, presentations and announcements during the event. VMware has been called a ‘virtualisation superstar’ and is aggressively pursuing the position of market leader within the hybrid cloud software space, working closely with all of the industry’s hyper-scalers, more on which later.

But arguably the biggest buzz is being generated by two huge acquisitions that VMware has recently undertaken, which combined are worth the best part of $5 billion – the company’s biggest M&A activity in some time.

The first is the $2.1 billion purchase of Carbon Black, which it sees as central to its ambition to disrupt the end-point security sector. Speaking to Digital Bulletin in a quiet corner of one of the centre’s many breakout areas, Poonen explains why VMware wants to do more in the end-point security space.

“I’d argue with you that 50% of our 13,000 customers in networking, 40% of our 80,000 customers in computing use our products, so we have a business in security that is non-trivial, but we don’t really have a brand that is well known in this area. Now we’re going to create a brand on pure security by doing things more deliberately in that space and getting to know CISOs,” he says.

“We felt like while we had made significant progress in the networking security area, we were missing some of the capabilities that an end-point security solution had, and many of the existing players weren’t innovating anymore. Some were getting gobbled up by hardware players, while many signature-based AV solutions and legacy solutions were arcane and dying.”

The answer, Poonen and others felt, was to expand and formalise the relationship that had already been developed with Carbon Black, a cloud-native platform for end-point cybersecurity.

“Carbon Black is a next-generation security cloud that does this with a different architecture, is cloud native and AI-based, and could deal with data lakes. It was already a partner of ours for a couple of years, and we could see that it was thinking about security in a way that hadn’t been done before – the timing was perfect,” he comments.

It was announced at VMworld that Dell, which owns the majority shares of VMware, is making Carbon Black its preferred end-point security solution, which now will be provided to its millions of commercial customers. Poonen says that Dell has experimented at length with other vendors in the past, but saw the link-up between VMware and Carbon Black as the “perfect storm”, and hopes that other ecosystems will follow in its footsteps.

The second acquisitional play is the $2.7 billion buy of Pivotal Software, a cloud-native platform provider, which it plans to bring into the fold before the end of its 2020 fiscal year. As with Carbon Black, the two companies have a long history of collaboration reflected in the co-development and launch of VMware Pivotal Container Service in February 2018.

It feeds into VMware’s mission to become the ‘world-standard’ for containers and Kubernetes, with the purchase of Pivotal to complement the acquisition of Heptio, and the Kubernetes founders, which VMware completed in December last year.

“We’ve really embraced open source and the guys from Heptio – Joe Beda and Craig McLuckie – have helped us a huge amount. We wanted to make Kubernetes more mainstream, but also integrate it to a hypervisor like VMWare and that’s what we felt we could do [with Pivotal]. If you add to Heptio and VMWare’s efforts, Pivotal has 3,000 people that are making sure that the entire movement is all based on containers now,” says Poonen.

Tanzu is VMware’s recently announced brand name for its modern apps portfolio, which is to include Pivotal projects and products, and will be integral to its wider goal to help customers build modern applications, run Kubernetes consistently across environments and manage it all from a single point of control.

“We want to take those 3,000 people, $750 million revenue from Pivotal and put all the weight of VMware and Pivotal behind the effort on Tanzu. We think it’ll be a much better product than Openshift, Anthos or anything else because of the incredible innovation by the founders of Kubernetes, who are going to be driving that project roadmap going forward.

“It also has the go-to-market muscle of VMWare and Dell and other partners in the hardware space that are going to push it as a developer-ready architecture, and we are also going to take the elements of Tanzu and bake it into V-Sphere (VMware’s cloud computing virtualisation programme).

“The sky’s the limit on where we can take containers to, just in the same way the sky’s the limit on what we can achieve with security. We just keep adding more layers into the application layer and it becomes effectively like the new Java.”

It is fairly obvious that VMware’s relationship with the cloud hyper-majors is absolutely critical, and it is an area of responsibility that Poonen himself has taken on over the past three years.

It has been an overwhelming success with partnerships signed with Microsoft Azure, Google Cloud, Oracle and Alibaba, to go along with contracts that had already been inked with IBM and AWS, which was VMware’s first and preferred cloud partner.

“Our goal was to get all of the major cloud providers embracing VMWare because we have 70 million virtual machines, and customers might choose to move those virtual machines and run them on-prem or on public cloud,” he says.

“We need to be able to build a freeway into that global cloud that is monetisable on VMWare, and provide them a path into that cloud on or off; it’s the on ramp and the off ramp. We’ve been working really hard at a public cloud motion that will allow us to embrace those clouds and them us, and I’m pleased with the progress we’ve made.

“Companies are going to pick their clouds based on things we may or may not be able to control, so we need to be sure we can be there based on which provider they’ve chosen as a public cloud partner.”

The short-term priority, says Poonen, is to make sure the recent acquisitions are successfully integrated. They have not been cheap, he admits, and represent the biggest outlay by VMware in some years, meaning that tremendous focus and effort will go into ensuring Carbon Black and Tanzu become hugely important pieces of the VMware ecosystem.

Longer-term, Poonen says he will continue to focus his energies on growing the organisation’s core products in batches of 10,000 customers, targeting growth in its NSX network virtualisation and security platform, and its hypersonic architecture platform, HCI.

“NSX has got 13,000 customers, let’s help it get to 20,000. HCI has 20,000-25,000 customers, let’s get that to 30,000. We have 80,000 customers, tens of millions of devices, so we want to get to more than 100 million devices that we manage. Carbon Black has 6,000 customers so we want to get that to 20,000, for example.”

Poonen says that approach means VMware can set a realistic goal of achieving $20 billion in revenues in the medium to longer-term.

“We’re going to have a number of goals for our core products and each of them are on their way to or are already billion dollar businesses. If you get multi-billion dollar businesses inside a $10 billion or $11 billion company, you get a quicker path to a $20 billion,” he states.

“Today, VMware has compute, networking, management, end-user computing, and HCI – five businesses that are sizeable businesses with a number of customers. We are adding two more, the modern applications business that comes in with Pivotal, which is Tanzu, and we’re adding Carbon Black, so that makes seven businesses we can run at scale.

“These are not small businesses, they all are or have a path to $1 billion+, and if we can grow them to become substantially big businesses beyond that, we’re going to have a really rich portfolio.